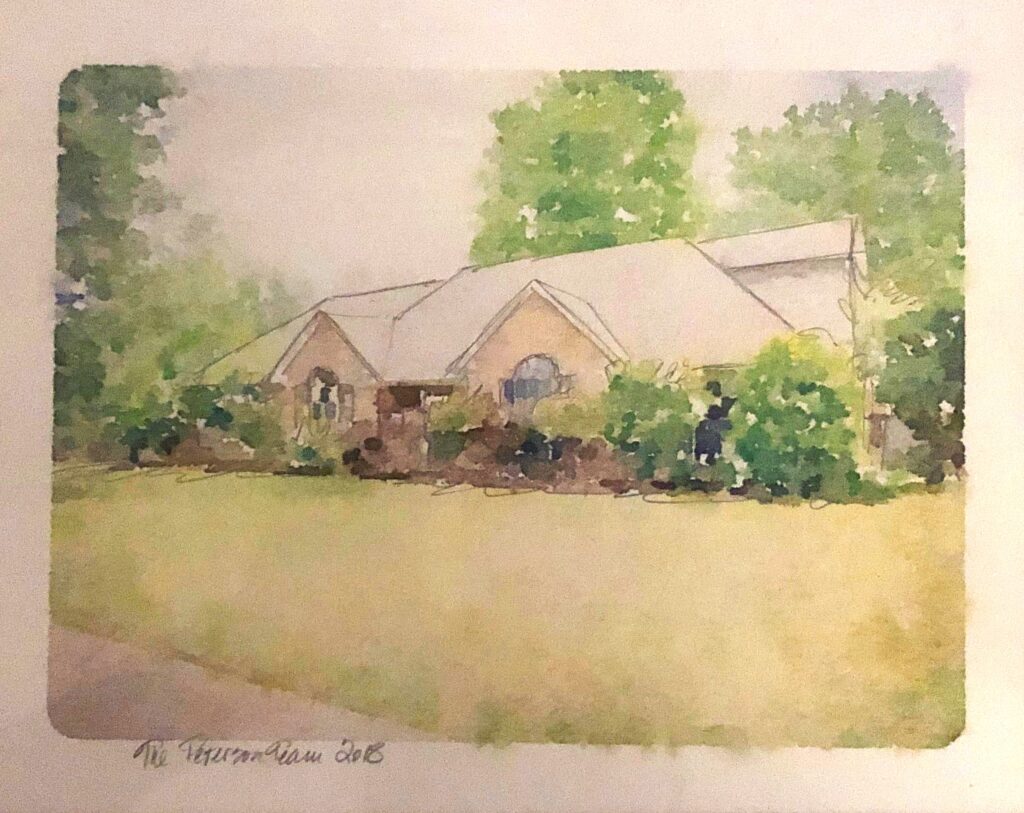

Picture Above: My First Home!

It’s springtime! And, alongside the season’s new blooms, eager homebuyers are also emerging from winter hibernation. Although many potential homebuyers are waiting on the sidelines, there’s still a good percentage ready to buy this year. The journey to buying a home in 2024 comes with many challenges, but with the right mindset and preparation, it is absolutely within your reach! I’ve compiled a few tips to help you navigate the housing market confidently and triumphantly:

Rising Interest Rates: As the economic tides change, so do mortgage rates. If you’re planning to buy, consider securing a rate lock to stabilize your monthly payments. This small step can have a big impact on your budgeting confidence. If you’re both emotionally and financially ready to buy, try not to be deterred by interest rates.

Limited Housing Availability: In many markets, there is a shortage of available homes, which can lead to bidding wars and inflated prices. Try expanding your search to less competitive areas, or consider homes that might need a bit of love. Sometimes, the best treasures are hidden.

Economic Uncertainty: In times of economic fluctuations, it’s important to remain flexible and informed. Keeping an eye on market trends will allow you to adapt your home-buying strategy as needed, ensuring you make a wise investment.

Escalating Home Prices: As home prices climb, it might seem daunting to keep up. Focus on what you can afford, and remember that the value of homeownership isn’t just in the price paid but in the life you will build there.

Stricter Lending Standards: With lenders tightening their requirements make sure your financial health is strong. Boost your credit score, reduce your debts, and save for a solid down payment. Get those preapprovals!

Fast-Paced Online Markets: The rise of online real estate platforms can lead to faster and more competitive bidding processes, often pushing buyers to make quicker decisions and potentially overpay for properties. Take your time to research, think critically, and choose a home that truly fits your needs and budget.

Navigating Regulations: Stay updated on any regulatory changes that could affect your home purchase. Knowledge is power, particularly when it comes to understanding your rights and obligations as a buyer.

Shifting Demographics: Pay attention to demographic trends that could influence the housing market. Whether it’s adapting to the needs of a growing millennial buyer pool or considering popular areas for downsizing boomers, understanding these shifts can offer strategic advantages.

Remote Work Adaptations: If you work remotely, prioritize finding a space that accommodates this lifestyle. A suitable home office can significantly enhance your productivity and work-life balance.

Remember, buying a home is a significant milestone. And, despite these challenges, it remains an attainable and worthwhile goal. Stay determined, use these strategies, and keep your eyes on the prize. Your future home awaits, ready to be filled with new memories and achievements.