Strategic Gifting

The Benchmark team considers it an honor to guide you in your charitable giving. We can help you discover ways to be strategic, purposeful, and impactful in your giving.

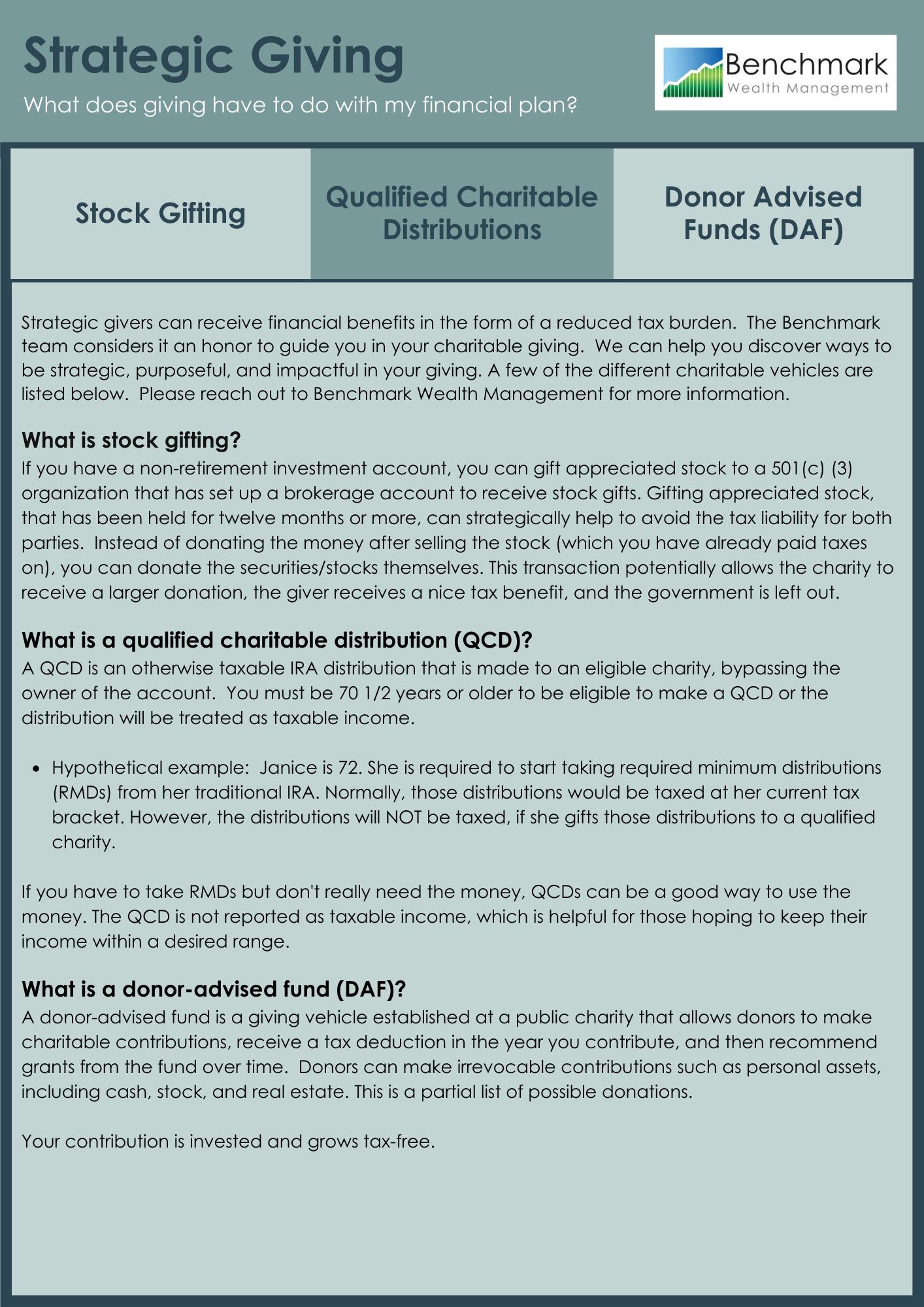

What is Stock Gifting?

If you have a non-retirement investment account, you can gift appreciated stock to a 501(c) (3)

organization that has set up a brokerage account to receive stock gifts. Gifting appreciated stock, that has

been held for twelve months or more, can strategically help to avoid the tax liability for both parties.

Instead of donating the money after selling the stock (which you have already paid taxes on), you can

donate the securities/stocks themselves. This transaction potentially allows the charity to receive a larger

donation, the giver receives a nice tax benefit, and the government is left out.

Who Should I Give To?

Consider organizations close to your heart and close to your home. (1) Ensure the organization is an

IRS-approved charity. (2) Ask for financial reports. A non-profit should be willing and able to share its

990 tax form with you. (3) Find out what percentage of the organization’s annual funds go directly to

support its mission. Some standards suggest at least 60% of the revenue should go to mission-related

activities and no more than 40% should go to administrative expenses. (4) Ask for program results.

Request reports that measure results of the organization’s work during the past year.

Tools We Find Helpful

Strategic Gifting Guide

Strategic givers can receive financial benefits in the form of a reduced tax burden. This guide explains what it means to give strategically.

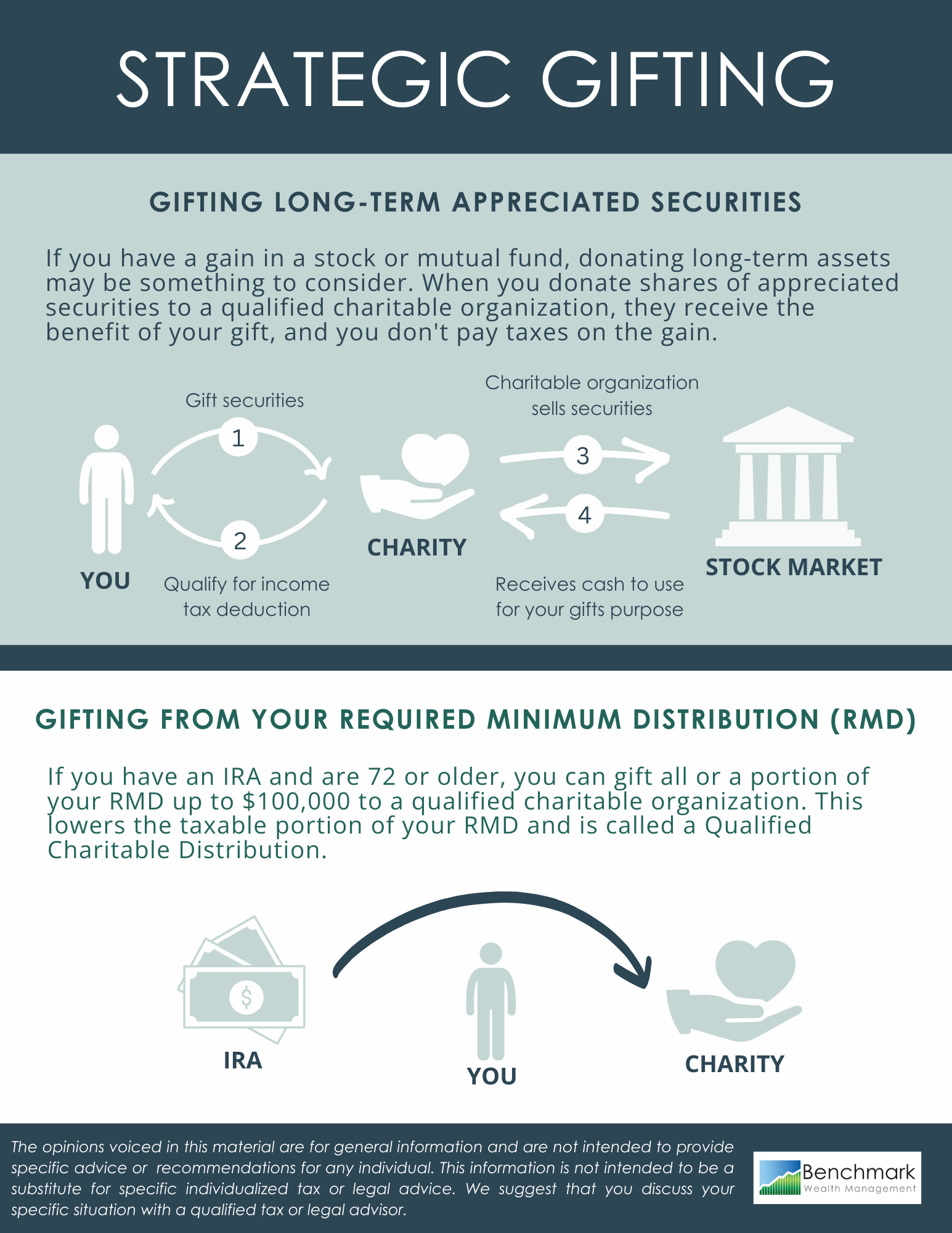

Gifting QCDs + Long-Term Appreciated Securities

This graphic shows the difference between these options.