Returning to work after maternity leave is a milestone filled with emotional tension – excitement and anticipation mixed with grief and mild anxiety at leaving a new precious baby. As a mother of two young boys, I’m navigating the joys and challenges of expanding our family while keeping an eye on our financial health. Achieving harmony between family, work, and financial well-being is an ongoing journey, but it’s possible with thoughtful planning and a flexible approach. Here are some strategies that have worked for our family, and I hope they inspire other parents and caregivers striving for the same balance.

Embrace the Power of Routine

A whole new person enters the scene, and family dynamics change and grow, ultimately for the best. One of the most significant adjustments after welcoming a new baby is re-establishing a routine. Babies thrive on consistency, and so do adults. Creating a daily schedule that accommodates family time, work commitments, and personal care can make a world of difference.

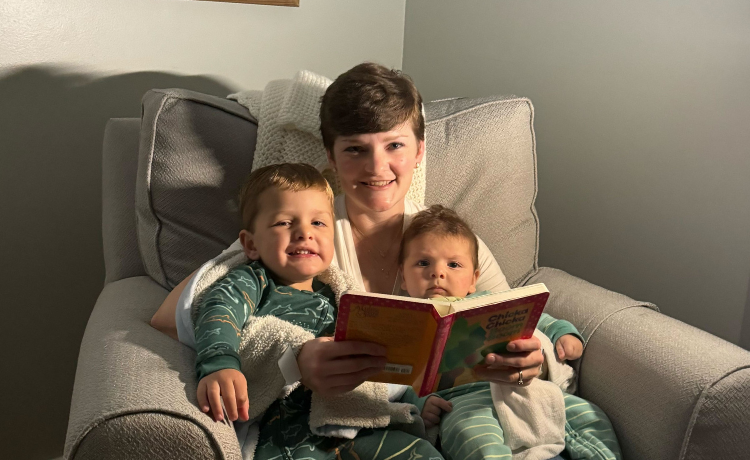

Our family leaned into distinguishing between “glass ball” vs “plastic ball” priorities. Glass ball priorities are crucial, and an absolute must, as neglecting them will result in them shattering. Plastic ball priorities can fall by the wayside and bounce back. Making sure our boys are well fed and loved…glass ball. Doing laundry or cleaning the dishes…plastic ball. In our household, we carve out time for family breakfast (even if rushed) and family dinner without phones. Evenings are reserved for unwinding, with dedicated time for play, baths, and bedtime stories. Our routine helps maintain a sense of normalcy and ensures everyone gets the attention they need. My husband and I lightly hold our routine. As anyone with kids knows, the unforeseen will always happen; hiccups will occur. So, a sense of humor and a ton of prayer go a long way.

Budgeting for the Unexpected

Having a baby brings immense joy and fulfillment, but it also comes with financial surprises. From medical expenses to baby gear, costs can add up quickly. To prepare for baby’s debut, consider setting aside at least three to six months of expenses in high-yield savings as an emergency fund for peace of mind. Research what medical expenses and supplies may or may not be covered by health insurance. Building a flexible budget that accounts for unexpected expenses is crucial; reassess your budget periodically and adjust as necessary.

Before I went on maternity leave, we set aside 3 months of expenses in savings as an emergency fund since I did not draw a salary for part of my leave. We used a health savings account (or HSA) to cover hospital costs. We keep a “baby” line item in our budget as we get a feel for our monthly average cost of diapers, clothes, etc. Since returning to work, my husband and I have been steadily building up our emergency fund again. This cushion has been a lifesaver for covering those unforeseen costs without disrupting our overall financial goals. Most importantly, we have peace of mind.

Prioritize Self-Care

As parents and caregivers, we often put our needs last (I’m often guilty of this!), but self-care is essential for our physical, emotional, and mental health. If you take care of yourself, you’re better able to care for and love your family well. Self-care looks different for each person. What fills your cup and gives you peace? Whether it’s quiet morning prayer and reading, a cup (or two!) of coffee, a short walk, or lifting weights, finding brief moments for yourself can rejuvenate your spirit and help you recenter in the midst of the beautiful chaos.

I’ve found that carving out space for self-care makes me more focused and patient, both at home and at work. I can more lovingly navigate those toddler meltdowns and soothe my crying baby. Remember, caring for yourself and your body is paramount. Be kind to yourself and give yourself abundant grace – you do it for everyone else, so why not yourself? Remember, you’re doing a great job!

Streamline Your Finances

With a new baby, time becomes a precious commodity. Simplifying your finances can save you valuable time while reducing stress and decision fatigue. Automating bill payments, consolidating accounts, and using financial planning tools can help you stay organized.

My husband and I quickly review our budget together once a month and reprioritize money goals as needed. We use a budgeting app that tracks our expenses and savings goals, giving us a clear picture of our financial health without the need for constant manual tracking.

Set Realistic Work Goals

True work-life balance doesn’t exist, but finding harmony between the two is possible. Setting realistic goals and expectations at your job, communicating your and your family’s needs well, and maintaining healthy boundaries are key. Have transparent conversations with your employer about your new responsibilities at home and explore flexible work options if available. Find an accountability buddy and reassess your schedule periodically to see if you need to make any tweaks.

For me, this meant temporarily adjusting my work hours and occasionally working from home. I fully expect my work schedule to continue evolving as my family’s needs change, and so should you! Setting achievable work goals ensures you remain highly effective without feeling overwhelmed.

Plan for the Future

Financial planning is a long-term game, and having children makes it even more critical. Start by setting up or revisiting your savings plans, retirement accounts, and college savings funds. Reassess your estate planning documents, including wills and powers of attorney, paying close attention to setting up guardians for your minor children.

Control what you can today to best prepare for our family’s future needs, whatever they may be. We opened a 529 college savings plan for each of our boys shortly after their births, and we’re encouraging family members to donate to the boys’ plans as they feel led. Keep in mind consistent contributions, regardless of what the market is doing, as well as time in the market are on our side.

Cherish Family Time

Amidst the hustle, I have to remind myself to cherish moments with my family and find joy in the seemingly mundane. Simple activities like family dinners, weekend outings, or even a game night can create lasting memories and strengthen your family bonds. These years, though demanding, are precious and fleeting. Make it a priority to disconnect from work and be present with your loved ones. Balancing family, work, and financial health is a dynamic process that evolves with every family’s needs. May you find peace and fulfillment in this blessed, chaotic journey of parenthood!