Estate Planning

A thoughtfully created estate plan can provide peace of mind. Your plan should reflect your wishes and goals.

What Is My Estate?

Your estate is the sum of your assets minus your liabilities. Estate planning is the process of anticipating and arranging, during your life, the management and transfer of your estate during incapacity or death.

There are critical goals behind making a plan for your estate. A thoughtfully created estate plan creates provisions that allow trusted family or friends to access control of your assets. It provides peace of mind by protecting your family and ensures your wishes are legally binding through legal documents.

What is Estate Planning?

Estate Planning is a series of preparation tasks that dictate how your assets will be distributed during incapacity or death. Your assets include real estate, cars, financial products, and financial accounts. Estate planning involves assigning a power of attorney and a healthcare proxy, creating trusts, establishing guardians for dependents, appointing beneficiaries to life insurance and retirement accounts, making funeral arrangements, and preparing for estate taxes.

Estate plans should be reviewed every few years and especially when you experience a life-changing event. This ensures that your plan reflects your current wishes and goals.

What Documents Should I Have In Place?

- Will

A will is a legally binding document that dictates how your assets will pass to your heirs. It may also include information about how specific items are to be dealt with and, if you have children, who will care for them and how. After death, the will must be validated through a public process known as probate. Your estate executor or the attorney representing your estate initiates probate.When you die without a will, its called dying intestate. In this case, the state law determines how to distribute everything you own.

- Healthcare Power of Attorney (Healthcare Proxy)

This document grants an agent permission to consult with your doctor about your healthcare needs and make healthcare decisions on your behalf.

- Living Will

This document specifies your wishes regarding certain end of life decisions. Example: What do I want to happen if I can’t breathe on my own?

- Financial Power of Attorney (POA)

This document designates an agent who is allowed to handle your financial affairs, on your behalf, while you are living.

- General Power of Attorney (POA)

A document that designates general permission to an agent who is allowed to handle your business affairs and transactions. This is helpful if you are incapacitated or out of the country. - Trust

Trusts are legal arrangements where a third party holds assets on behalf of a beneficiary or beneficiaries. Trusts are often used to ensure trust assets are distributed according to the wishes of the trust creator. Trusts allow a beneficiary to avoid the public probate process.

Tools We Find Helpful

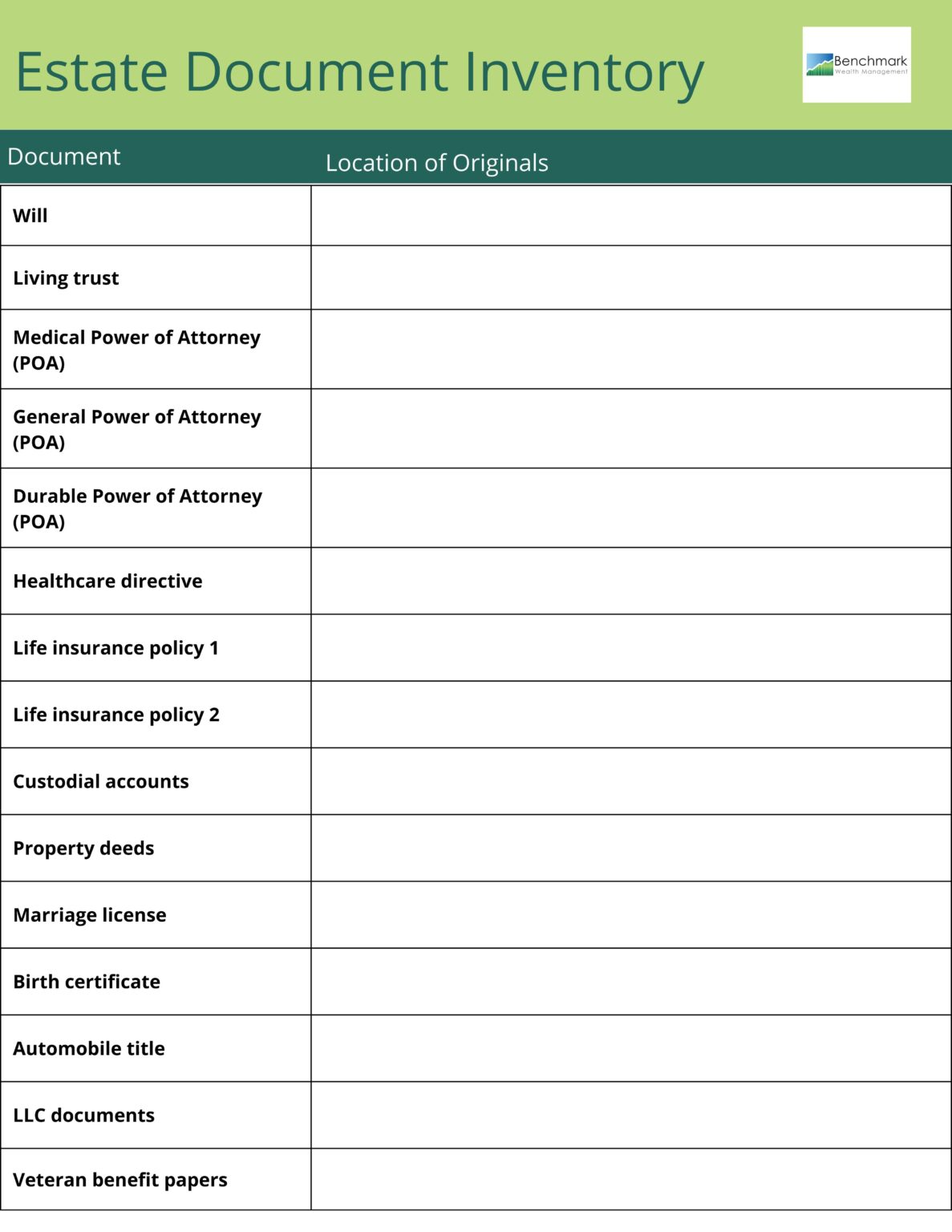

Estate Document Inventory

A central inventory of your financial picture is critical when settling your estate.

Steps To Take When a Loved One Passes

This guide will walk you through the immediate and future steps to take.