My family went to Disney World in 2022, which is also the year in which I learned that I’m not relaxed enough to enjoy things that lay at the intersection of logistics and “fun.” I have no chill, as they say. More recently, another Magic-Kingdom-Scorned mom and I were bonding over our magically induced shared trauma, it struck me how similar Mickey’s famed theme park is to our US presidential election years.

Parades. A lot of show. Long lines. Hours of planning and research. Beloved characters in costume. Possibly even a desperate search for overpriced adult beverages when the screaming gets too loud.

But the real similarity, the one that sparked that initial connection, is that Disney World and election years both come with tremendously hyped-up expectations.

According to your uncle, the country will fall apart if so-and-so wins. According to your coworker, you should move to Canada if so-and-so loses. As financial advisors, we don’t often hear about the realities of exhausting family vacations; but we do hear heart-wrenching concerns over someone’s ability to retire, or to continue feeling secure enough to invest. All this, contingent on the outcome of a national election.

The uncertainty, the speculation, the fear of the unknown—elections bring a cocktail of emotions that can lead even the most seasoned investors to question their strategies. But here’s the thing: when it comes to your investments, political party affiliation and election years aren’t reliable indicators of market performance. So before you swear off Presidential Debates for good, let’s take a closer look at the numbers.

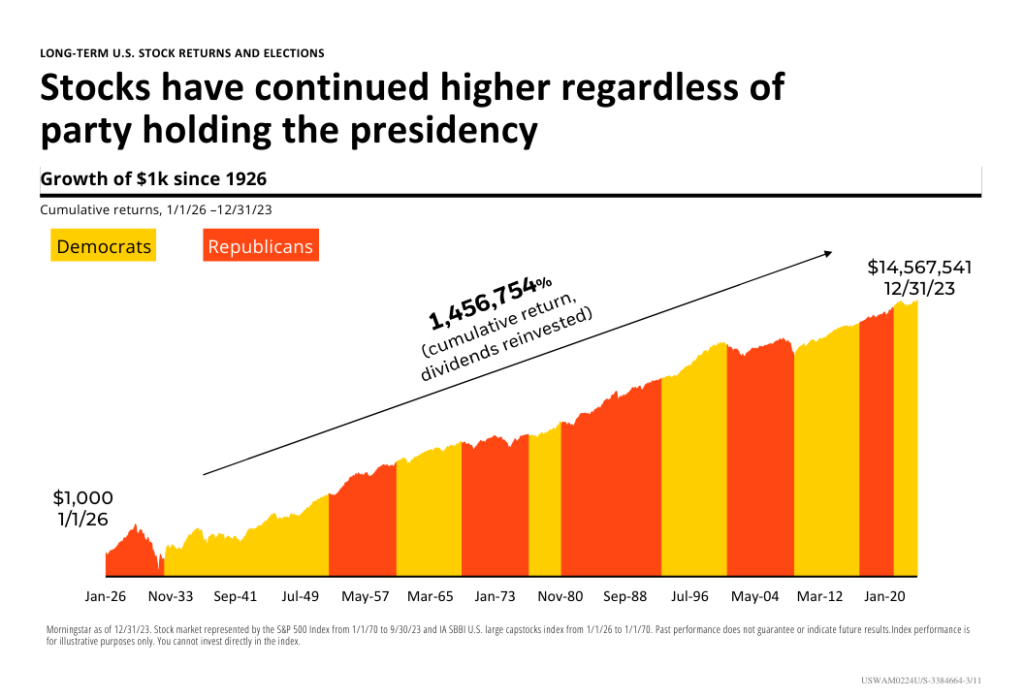

Historical Performance is More Consistent than we Give it Credit For

The stock market has averaged 9.9% per year (assuming reinvested dividends) since its 1928 inception. Within that timeframe, we’ve had 16 different presidents (8 Republican, 8 Democrat), and the chart below shows that that growth has taken place through them all.

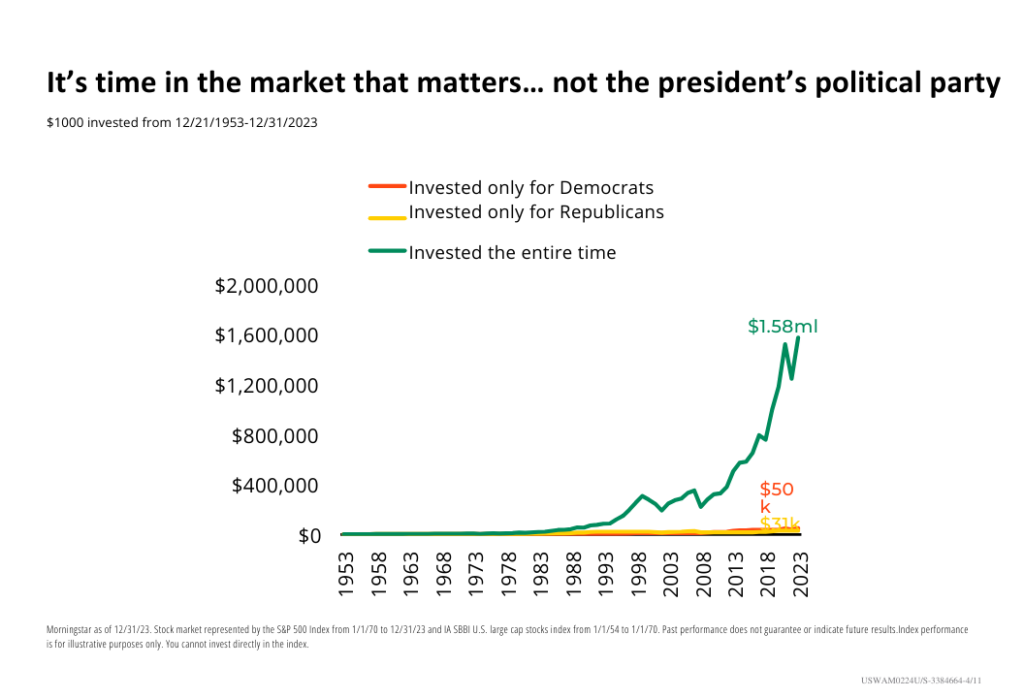

Investing based on Party in Office Does Not Work

In fact, the comparison between a Democrat-only investor, a Republican-only investor, and an investor who remains in the market no matter what is stark, to say the least. Assuming a $1,000 investment in the S&P500 index from 12/31/1953 to 12/31/2023, here is how they stack up:

- The investor who was only in the market during Democrat tenures would have had $50,000.

- The investor who was only in the market during Republican tenures would have had $31,000.

- The investor who remained in the market no matter what would have had $1.58 million. Let that sink in.

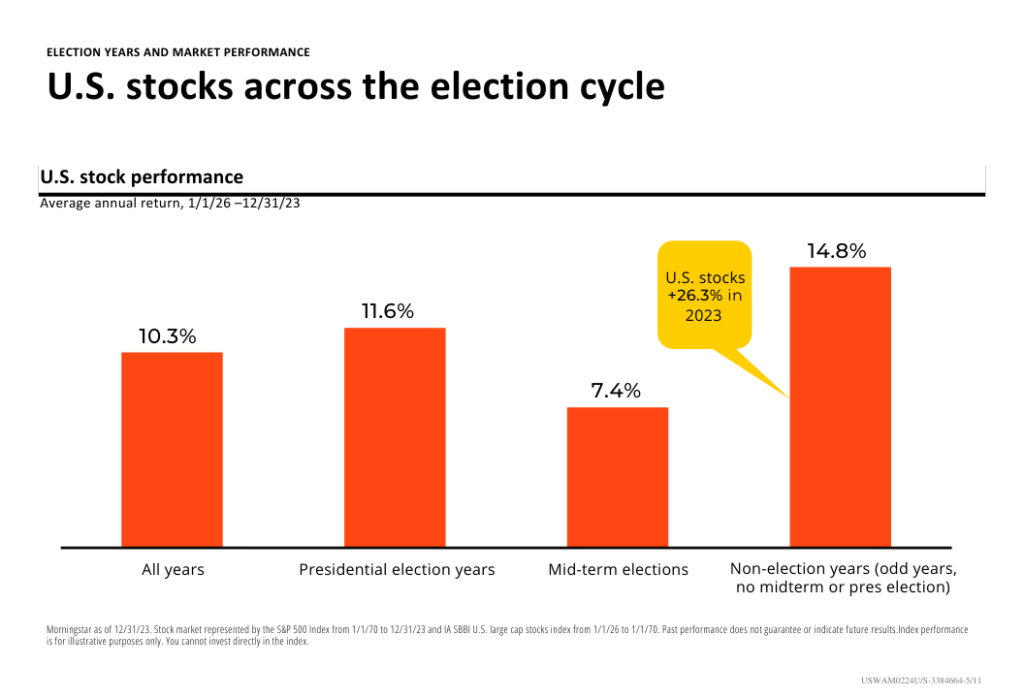

Election years Perform Better than Most Think

The S&P500 has averaged 11.6% in election years since 1926. In fact, only 2 election years in recent history have yielded negative returns, and that was due to overpriced asset bubbles, not politics (2000, 2008).

Am I saying that elections aren’t important? Not by the ears on my Minnie Mouse headband. Still, recognize that other factors have more influence. Economic stimuli, corporate fundamentals, balanced inflation, and favorable interest rates, just to name a few. While politics impact all of these, the color—red, blue, or purple—doesn’t seem to outpace in one direction or the other.

At the end of the day, money is apolitical. What matters is staying focused on your long-term investment goals and avoiding knee-jerk reactions based on political headlines and TikTok influencers (we’re all susceptible). Focus on what you can control, and call your advisor when you need a pep talk. We will remind you that the economy isn’t solely reliant on elected officials. It’s driven by the hard work, innovation, and determination of individuals like you.

And like our trip to Disney, remember that the stress of election years is momentary. Eventually, the frustrated memories turn sweet. We remember how lucky we are to live in a country where Democracy exists, and we see in hindsight how election drama, like the Dewey v. Truman scandal that surely you remember, did not, in fact, unravel our country. We realize that the ride lines weren’t so bad, and we remember that it was pretty fun to trick our kids into believing that puppies would meet them at the top of the “Tower of Terriers” (No? Just me?).

Come to think of it, maybe we should do it again one day.

Perhaps in four years.

Source: BlackRock Student of the Market: Election Year Special

All indices are unmanaged and may not be invested into directly.